How to Properly Set Up Cash App in 2025: A Simple Guide for New Users

In the fast-paced world of mobile banking, understanding how to set up Cash App is essential for new users looking to streamline their financial transactions. This guide provides a comprehensive overview of the Cash App setup process, from installation to verification, helping you get started with confidence. Whether you want to manage personal finances, business payments, or optimize your app experience, this simple guide covers all the necessary steps.

Getting Started: Cash App Installation

First and foremost, to benefit from the features that Cash App offers, you need to download and install the app on your mobile device. The Cash App app installation is straightforward and user-friendly.

1. Downloading the Cash App

To create your Cash App account, you must download it from the official website or through your device’s app store. The app is compatible with both iOS and Android operating systems. Simply search for “Cash App” in the store, and tap on the download icon to begin installation.

2. Accessing Cash App Features

Once the installation is complete, open the app and familiarize yourself with its mobile features. The intuitive design allows users to navigate easily through various functionalities, including sending and receiving payments, checking transaction histories, and managing account settings.

Cash App Registration Process

Now that you’ve installed the app, the next step is to go through the Cash App registration process. This process is vital for securing your account and ensuring user safety.

1. Creating Your Cash App Account

To create a Cash App account, you need to provide basic information like your email or phone number. Upon entering your details, you will receive a confirmation code via SMS or email. Enter this code in the app to confirm your identity and complete the registration.

2. Verifying Your Identity

Next, verifying your identity is crucial for maintaining security and complying with financial regulations. Cash App may request further information to verify your identity. This may include your full name, date of birth, and Social Security number. Following the verification process helps enhance your Cash App security settings, ensuring that your transactions are protected.

Linking Bank Account and Payment Methods

Having connected your bank account to Cash App enables you to send and receive funds seamlessly. Let’s delve into how to link your bank account and understand various Cash App payment methods.

1. Linking Bank Account to Cash App

From the Cash App menu, navigate to the Banking tab, where you can add a bank account. For linking your bank account to Cash App, simply select the option to add a bank account, enter your bank details, and confirm the link with a verification process. This step is essential to utilize features such as direct deposits and instant transfer capabilities.

2. Exploring Payment Methods

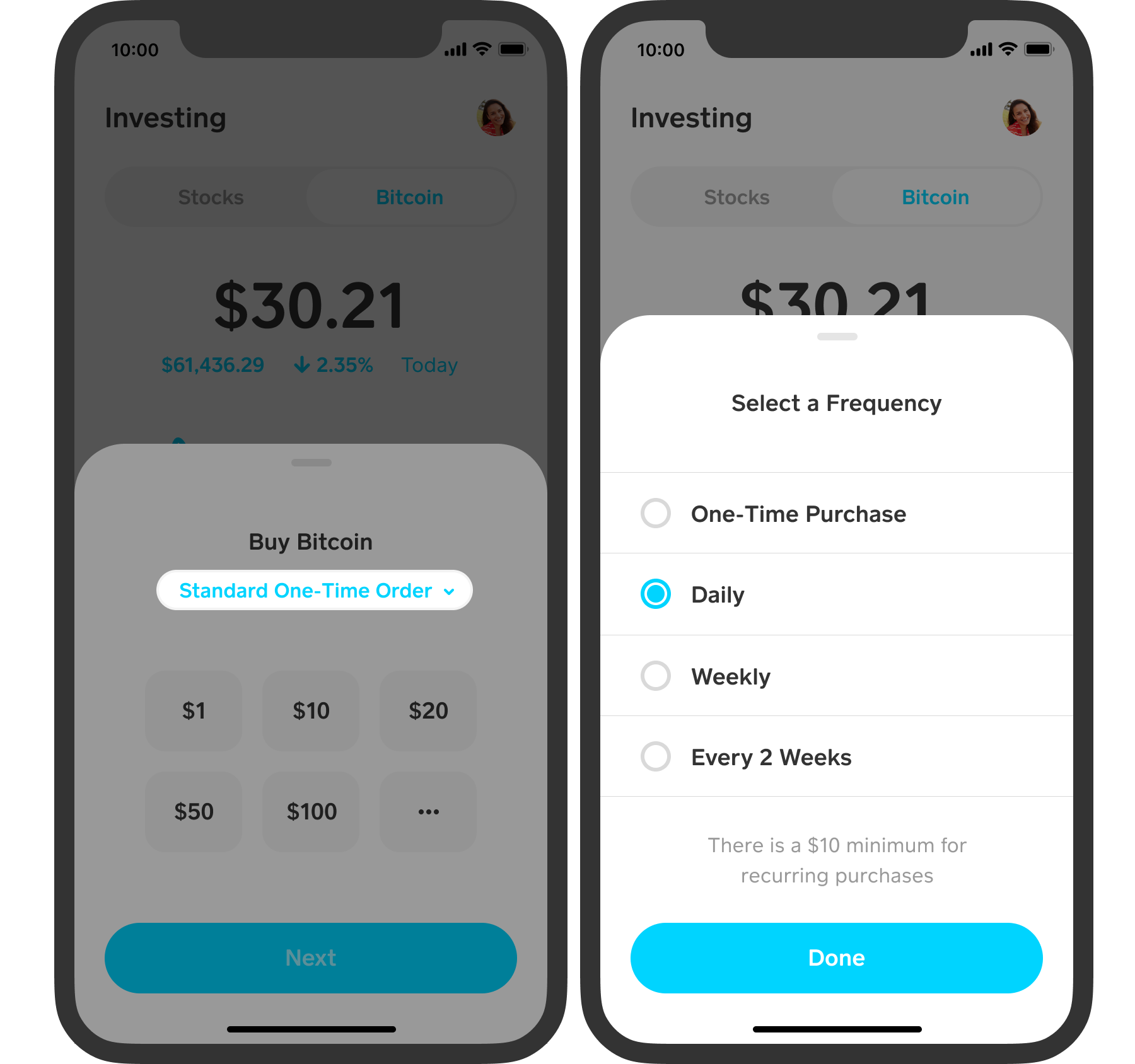

Cash App offers numerous payment methods, including Cash App direct deposit, peer-to-peer payments, and Cash App QR code payments. Users can receive salaries directly into their Cash App accounts, pay friends through their unique cash tag, or scan QR codes for swift payments, making it a flexible choice for managing finances.

3. Setting Up Cash App Card

Cash App provides a free debit card for convenient spending. Upon creating your account, you can request a physical Cash App card setup which you can use to make purchases wherever Visa is accepted. This card allows instant access to funds in your Cash App wallet.

Optimizing Your Cash App Experience

To truly harness the benefits of Cash App, understanding the various Cash App app features is essential. Let’s discuss tips for enhancing your user experience and the app’s security.

1. Cash App User Experience Tips

Make the most of your Cash App experience by customizing settings to fit your needs. Regularly check for app updates to utilize any new features. Configure notifications to keep track of transactions easily, and set up Cash App privacy settings to maintain control over who can see your account activity.

2. Managing Cash App Settings

Effective financial management using Cash App involves familiarizing yourself with your account settings. Under the account menu, you can manage transaction limits, adjust notification preferences, and switch between personal and Cash App business account setup for those using Cash App for business payments. This helps you maintain clarity in your personal and business finances.

3. Cash App Troubleshooting Guides

In case of issues like Cash App login issues or the app not functioning as expected, you can access troubleshooting guides through the Cash App customer support resources. These guides provide solutions for common problems, ensuring users can easily navigate any hurdles they encounter while using the app.

Cash App Fees and Support

Understanding Cash App fees and charges is vital as it directly affects your financial management strategy. Additionally, knowledge about customer support avenues helps users resolve issues effectively.

1. Understanding Cash App Fees

Cash App primarily charges fees for instant transfers and ATM withdrawals. It’s crucial to familiarize yourself with the transaction limits and fee structures to optimize your finances better and avoid unexpected charges.

2. Accessing Cash App Customer Support

Users can easily access Cash App customer support through the in-app support section. Additionally, the Cash App community forums provide valuable support resources and a platform for users to share experiences. These channels enhance your experience by empowering you to seek help when needed.

3. Utilizing Cash App Promotions and Offers

Keep an eye on Cash App promotions and offers that can enhance your cash management strategies. These promotions can include cash-back offers, referral programs, and discounted services, which can be beneficial in maximizing your funds.

Key Takeaways

- Download and install the Cash App to create your account.

- Link your bank account for seamless transactions and understand various payment methods.

- Optimize your app experience by setting up personal preferences and security settings.

- Stay informed about fees and utilize customer support options effectively.

FAQ

1. How do I reset my Cash App password?

If you’re facing issues with your Cash App login, you can reset your password by tapping on the “Forgot Password?” option at the login screen. Follow the prompts to verify your identity through your registered email or phone number, and then create a new password.

2. What if the Cash App is not working on my device?

For issues relating to Cash App app not working, ensure that the app is up to date. If it’s still not functioning properly, try uninstalling and reinstalling the app. You can also check for updates or outages by visiting Cash App’s official support channels.

3. Can I set transaction limits on Cash App?

Yes, you can set limits on Cash App transactions to better manage your spending. Navigate to your account settings to access options related to transaction limits and configure them based on your preferences.

4. How can I enable two-factor authentication on Cash App?

Enabling two-factor authentication enhances your Cash App account security. You can set this up in the *Account Settings* by navigating to the Security section and turning on the Two-Factor Authentication option.

5. Are there account recovery options available?

Yes, in case you encounter issues such as losing access to your Cash App account, recovery options are available. Through the app, utilize the account recovery features, or contact customer support for further assistance.

6. What should I do if my Cash App card is lost or stolen?

If your Cash App card is lost or stolen, promptly disable the card through the app to prevent unauthorized transactions. Navigate to the Cash Card menu and select the option to disable your card immediately.

7. How can I make payments using QR codes on Cash App?

To use Cash App QR code payments, open your Cash App, select “Scan” from the home screen, and point your camera at the QR code. Once scanned, confirm the payment details and authorize the transaction. QR codes make for quick and easy transfers while avoiding manual entry errors.