“`html

How to Properly Fill a Check in 2025: A Smart Guide to Easy Payments

Filling out a check might seem like a simple task, but knowing the essential details is crucial for ensuring your payment goes through without a hitch. In this guide, we’ll delve into check filling, offering practical tips and advice that will walk you through the correct process of how to fill a check, keeping common pitfalls to a minimum. Whether you’re writing a check for rent, services, or other payments, mastering this skill is vital for effective financial management.

Understanding Essential Check Details

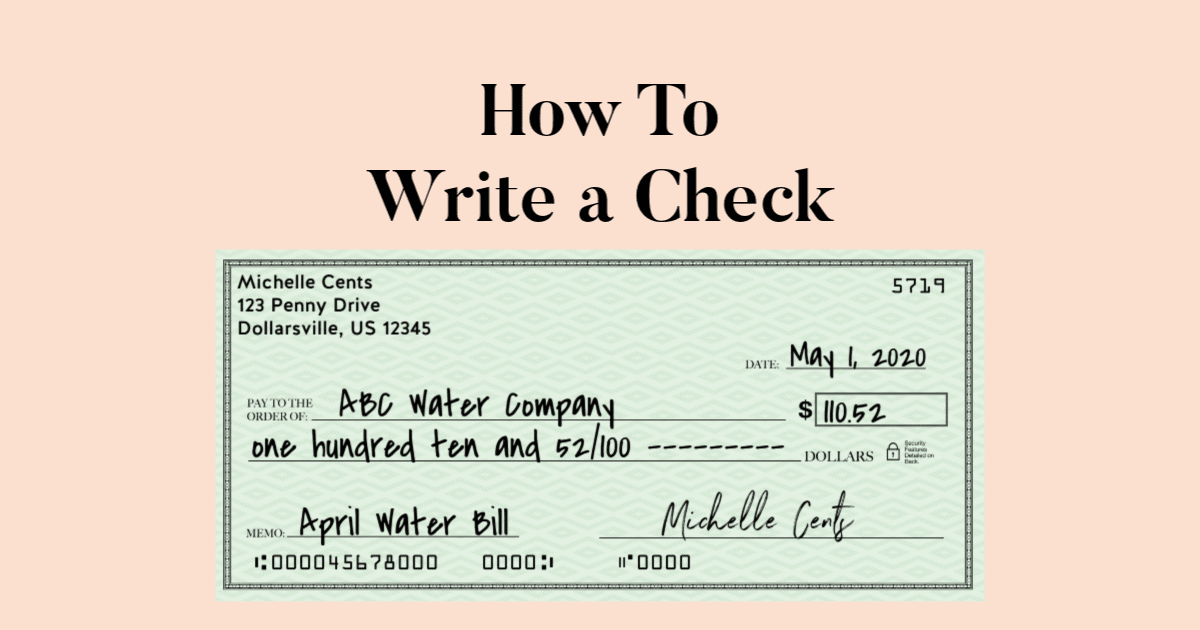

Before diving into the check-filling process, it’s important to understand the necessary information required on a check. There are specific elements that every payer must include to prevent check cashing errors. Key details include the date, payee name, amount in both words and numbers, memo (if applicable), and your signature. Noting these will ensure your check is processed smoothly.

Check Date Importance

The date on a check signifies when the payment is intended to be executed. It’s essential to include the correct date since checks can be dated for future payment. Many banks will not cash a stale-dated check, typically one that is more than 6 months old, which makes understanding this dynamic critical for the check filling process. Always use the current date to guarantee a prompt transaction.

Writing Amounts on Checks

Filling out the amount is arguably the most crucial step in teaching how to write a check correctly. Write the amount in the small box on the right side and also in words on the line below the payee information. If the two amounts do not match, the worded amount takes precedence. It’s advisable to always double-check these figures to avoid check filling mistakes that can lead to payment disputes.

Step-by-Step Check Filling Process

To successfully navigate the check filling process, following a step-by-step guide is beneficial. Here are the steps to ensure clarity and accuracy in your payment method:

Step-by-Step Check Filling

- Write the Date: Begin in the upper right corner.

- Payee Details: On the line that says “Pay to the order of,” write the full name of the person or business you are paying.

- Filling the Amount: Write the amount in the small box and in words below.

- Memo Line: If necessary, write the purpose of the check (this can help for tracking down the payment later).

- Sign the Check: Your signature must match the one on file with your bank to be recognized as valid.

Each of these steps is vital to avoid common check errors and to make sure your payment reaches the right person efficiently.

Check Signing Techniques

Your signature is your authorization for the check to be cashed or deposited. It should be signed on the line on the bottom right corner, and it’s crucial to reproduce your official bank signature to avoid issues. Experimenting with different signing techniques can also result in your signature being changed, thus affecting the check’s validity. Keep this in mind when learning about how to fill a check.

Avoiding Common Check Mistakes

Even experienced check writers are prone to making mistakes. One of the best ways to improve your skill is by being aware of common errors in check writing. Being informed is a key part of establishing a smart and secure financial routine.

Common Check Errors

Errors like forgetting to include the date, misspelling the payee’s name, or writing the amount incorrectly are frequent mistakes that can derail your transaction. Ensuring that all fields are completed properly is one way to steer clear of these pitfalls. Always double-check details before submitting your check to preempt any issues during check cashing.

Check Filling Tips for Beginners

For those new to check writing, simplicity is often the best approach. Start by practicing in small amounts until you feel fully confident. Remember to keep your checkbook in an organized manner; this not only helps keep track of transactions but also reinforces effective check management.

Check Cashing Process and Safety Tips

Understanding how the check cashing process works is essential for managing your finances efficiently. When cashing a check, you must present valid identification and follow the bank’s verification procedures.

Check Payment Safety Tips

To reduce the risk of check fraud, it’s crucial to practice good habits. Always keep your checks secure, and never leave your checkbook in public places. Adding security features like unique ink or watermarks can enhance protection against unauthorized cashing.

Check Security Features

Modern checks can include a variety of security features. Look for watermarks, microprinting, or color-shifting inks to ensure the checks you’re writing and receiving are secure. Understanding these measures can provide additional peace of mind while managing your accounts and payments.

Key Takeaways

- Know essential check details to avoid errors.

- Practice good check writing habits for smoother transactions.

- Always prioritize security when managing checks.

- Utilize step-by-step guides for efficient check filling.

- Remain aware of common mistakes and tips to enhance your skills.

FAQ

1. What information do I need when writing a check?

You must include the date, payee’s name, amount (both numerically and written out), your signature, and optionally a memo for clarity. Ensuring all essential check details are correct is vital to avoid check filling mistakes.

2. How can I avoid check filling errors?

To avoid check filling errors, always double-check your entries, ensure the spelling of names is accurate, and verify amounts match in numbers and text. An organized approach reduces the risk of common check errors.

3. Are there specific security features I should know about checks?

Yes, modern checks may incorporate various security features such as watermarks, microprinting, and specialized inks. Familiarizing yourself with these can help in avoiding fraud and enhancing check payment safety.

4. How can I safely store my checks?

Storing your checks securely is essential. Use a locked location such as a safe and limit access to trustworthy individuals. Restricting access will enhance your check security measures.

5. Where can I find resources to learn more about writing checks?

Numerous online resources and tutorials are available to help with check writing skills. Websites like banking institutions often provide educational materials that discuss financial literacy in checks and effective payment practices.

6. What are the implications of incorrect check filling?

Incorrectly filled checks can result in delayed payments, frustrated recipients, and potential penalties for bounced checks. Being mindful of check filling requirements can mitigate risks and improve financial accountability.

“`