How to Send Money with Apple Pay: Effective Solutions to Simplify Your Transactions in 2025

In the rapidly evolving world of digital finance, the capability to send money with Apple Pay seamless provides great convenience and versatility. Apple’s mobile payment system enables users to quickly and securely transfer money, whether it’s for a shared lunch or a payment to a freelancer. In this comprehensive guide, we’ll discuss how to effectively leverage Apple Pay features, from setup to managing transactions, ensuring you can use Apple Pay to send money effortlessly in 2025.

Understanding the Apple Pay Transaction Process

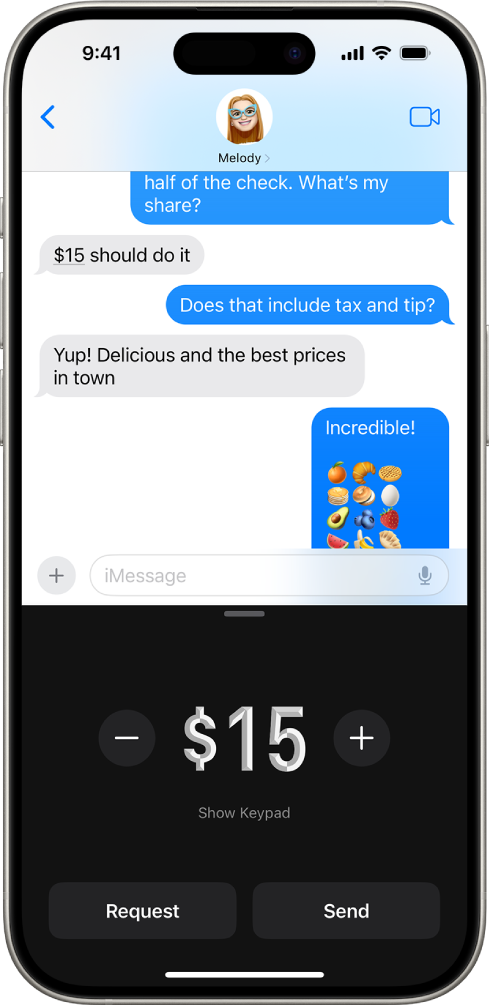

The Apple Pay transaction process is designed for simplicity and speed. To send money with Apple Pay, you typically need to ensure your Apple Pay is set up on your iPhone or Apple device. Begin by accessing the Wallet app, where you can manage your cards and funds. You’ll also need to make sure you’ve linked your bank account or credit card, which can be done easily through the app settings. Once these are done, sending money is as simple as selecting a recipient in your Contacts, entering the amount, and confirming the transaction with Face ID, Touch ID, or your passcode.

Key Steps in Setting Up Apple Pay for Payments

To effectively use Apple Pay, first make sure you have the latest version of iOS. You must enable the Wallet app, followed by adding your preferred payment method. This could involve linking a credit card as well as setting up a bank account for direct transfers. It’s essential to note that the app supports both peer-to-peer payments and traditional merchant transactions. You can access payment options within the Wallet app, where you can select what you wish to use for your next payment.

Linking Your Bank Account to Apple Pay

One vital step for anyone looking to send money on iPhone is the linking bank account to Apple Pay. Start by opening the Wallet app and selecting the ‘+’ sign. Follow the prompts to link your bank account, and Apple Pay will confirm your status as a registered user. This direct connection not only enables easy transfer of funds but also ensures those funds can be accessed through the Apple Pay Cash feature, allowing you to efficiently manage your balance.

Apple Pay Payment Security Features

When discussing the Apple Pay payment security, it’s critical to emphasize the robust protection mechanisms in place. Apple utilizes a process known as tokenization wherein sensitive payment information is modified into an unreadable code that can only be decrypted by authorized secure elements. Additionally, Apple Pay transactions require either Face ID or Touch ID, offering layers of security that many traditional payment methods don’t incorporate. This showcases Apple’s commitment to safeguarding user information and ensuring only authorized transactions are processed.

Understanding Apple Pay Fees and Limits

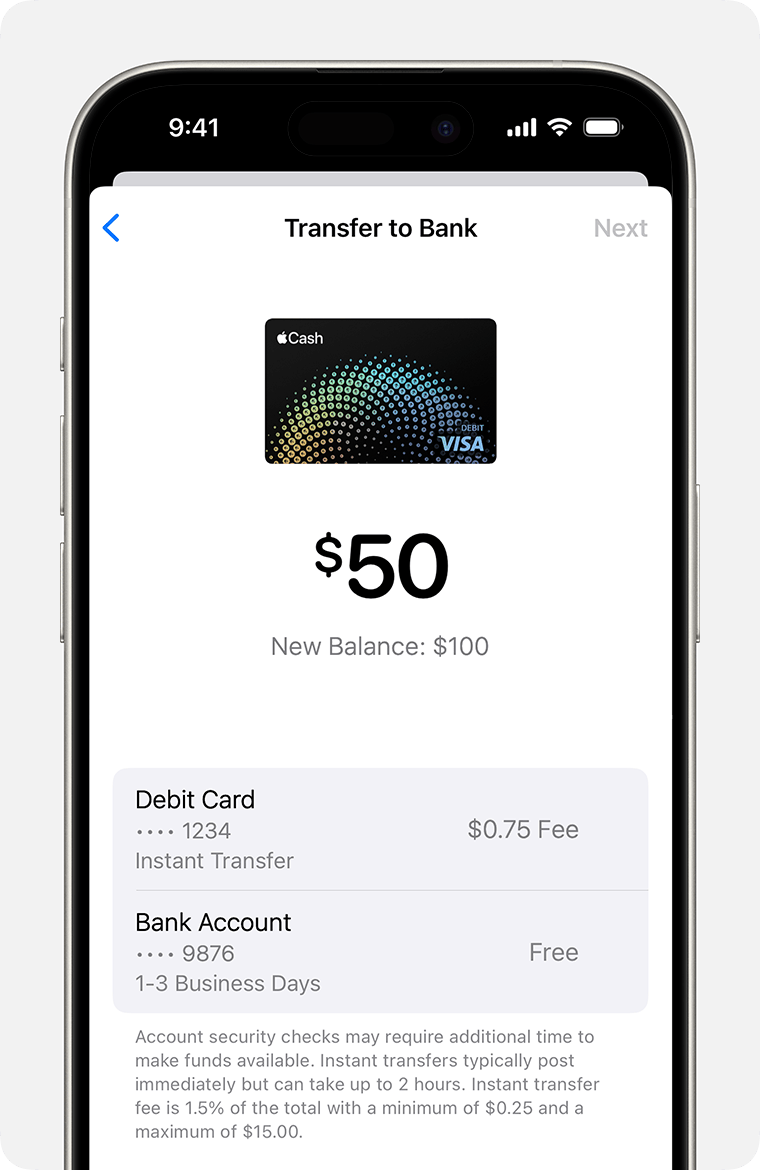

Knowing the Apple Pay fees and limits is crucial for efficient management of your transfers. While Apple itself does not impose fees for sending money with Apple Pay to other Apple Pay users, using a credit card for transactions could incur a standard transaction fee. Moreover, be aware of the transaction limits which may vary depending on whether you intend to send money internationally with Apple Pay or domestically. It is essential to check the latest settings in the app under ‘Apple Pay Cash,’ where you’ll find details about transfer limits and potential fees involved.

Apple Pay Cash Limit and Management

Another essential part of monitoring your Apple Pay usage is understanding the Apple Pay cash limit. Generally, the daily cash transfer limit is $3,000, and continuous transfers should be monitored to avoid any account terminations or overdrafts. Remember, you can view your transaction history directly within the app, ensuring you can make informed decisions about future payments.

Practical Comparison: Apple Pay vs. Traditional Banking

It’s advantageous to assess the benefits and limitations of sending money through Apple Pay against traditional banking methods. The convenience of instant transfers versus waiting for bank clearing times can be significant. Apple Pay offers immediate solutions without the more stringent regulations that banks may operate under, making it especially appealing for young users comfortable with technology. Compare this with the fees often charged for wire transfers and the impractical settings of sending international payments, and it’s clear how mobile payments are reshaping the financial landscape.

Enhancing User Experience: Tips for Apple Pay Users

To get the most out of Apple Pay, it’s vital to familiarize yourself with practical tips, including enabling notifications for transactions in the settings, which keeps you informed of your payment history. Ensure your contact details are up to date, making it easier when receiving money with Apple Pay. In addition, regularly check the Apple Pay help center for troubleshooting common issues, allowing you to maintain smooth operations in your payment preferences.

Using Apple Pay for Small Businesses

For small businesses, Apple Pay for small businesses can increase transaction efficiency and customer satisfaction, with the added bonus of fostering loyalty among tech-savvy customers. Accepting Apple Pay uses contactless payments, which are not only quicker but also appealing to a broader audience. Setting up Apple Pay on your business devices can involve linking your standard point-of-sale hardware with a payment service app compatible with this payment format. Be sure to take advantage of customer feedback to tailor your implementation for maximum benefits.

Apple Pay Integrating with Merchant Payments

Conducting Apple Pay merchant payments can streamline sales processes significantly. This can be achieved through software solutions or built-in capabilities in newer point-of-sale systems, making it easy for the business user to manage transactions flawlessly. Also, consider the opportunity to leverage user data through transaction records to offer targeted marketing initiatives.

Enabling Apple Pay for Expected Use Cases

When planning your business strategy, it’s crucial to consider scenarios where Apple Pay payment options might enhance customer experiences. Adding Apple Pay as a payment method can facilitate impulse buys and speed up overall transaction processing, especially during peak hours. Ensure staff recognizes it as an accepted method to optimize service times, helping improve overall customer satisfaction.

Final Thoughts and Summary

In conclusion, mastering how to send money with Apple Pay is an invaluable skill that can make everyday transactions simpler and quicker. From understanding the operation of Apple Pay to the financial aspects like limits and fees, it’s an application that many may find beneficial in 2025. The detailed insights provided above help simplify using this digital wallet to fit both personal and business needs.

Key Takeaways:

- Understand the Apple Pay transaction process and security features.

- Know your Apple Pay fees and cash limits to better manage transactions.

- Utilizing Apple Pay can be advantageous for both personal use and small businesses.

- Keep up-to-date with Apple Pay notifications and transaction history.

- Effectively integrate Apple Pay into small businesses for increased sales efficiency.

FAQ

1. How secure is sending money through Apple Pay?

Apple Pay uses advanced security measures, including encryption and tokenization to protect your transaction data. This ensures that your personal information remains secure while you transfer money with Apple Pay.

2. Can businesses easily integrate Apple Pay?

Yes, businesses can enable Apple Pay for merchant payments by linking with compatible point-of-sale systems. This process typically involves simple integration through software that recognizes Apple Pay as an accepted payment method.

3. What are the limits for sending money with Apple Pay?

Users can typically send a maximum of $3,000 in a single transaction, with a total limit set on daily transfers. Users should refer to their account settings in Apple Pay for the most accurate details.

4. Can I receive money with Apple Pay?

Yes, you can easily receive money with Apple Pay when someone sends you funds through the app. All you need is your associated Apple ID and linked payment methods.

5. What happens if I encounter issues while using Apple Pay?

If you face challenges using Apple Pay, the Apple Pay help center is an essential resource. It provides troubleshooting guidance, and users can explore the common issues and how to resolve them.