How to Calculate EBITDA: Simple Methods for 2025

Understanding **how to calculate EBITDA** (Earnings Before Interest, Taxes, Depreciation, and Amortization) is essential for investors, financial analysts, and business owners alike. EBITDA serves as a valuable metric for assessing a company’s operational performance, allowing stakeholders to gain insights into its profitability without the influence of financial and accounting decisions. In this article, we will explore straightforward methods for **calculating EBITDA**, provide clarity on its significance, and offer practical steps and examples for a well-rounded understanding in 2025.

The EBITDA Definition and Its Importance

Before diving into the calculation methods, let’s first clarify the **definition of EBITDA**. This financial metric helps in assessing a company’s profitability by focusing on its core operational performance. By calculating EBITDA, stakeholders can eliminate the effects of interest, taxes, and other non-operational expenses, making it a more reliable indicator of a company’s **financial health**. Understanding the **importance of EBITDA** allows investors to gauge the true earning potential of a business without the bias of various accounting policies.

The Meaning of EBITDA in Business

The **meaning of EBITDA** extends beyond a simple formula; it’s about recognizing a business’s ability to generate earnings from its operations. As businesses often face diverse financial strategies and tax implications, using EBITDA gives investors a clearer view of a company’s operating efficiency. In addition, it serves as a more straightforward comparison tool across different firms within the same industry, which is crucial during **business valuation** processes.

EBITDA Significance in Financial Analysis

The **significance of EBITDA** unravels when analyzing a company’s financial statements. With most stakeholders interested in profitability metrics, EBITDA acts as a bridge between top-line revenue and bottom-line net profit. Utilizing EBITDA helps in identifying a company’s **operational efficiency**, enabling comparisons with market peers. The focus on core earnings makes it particularly relevant for **financial analysis**, providing distinct insights that encompass revenue generation capacity while filtering out external factors.

Effective EBITDA Calculation Methods

There are multiple strategies for **calculating EBITDA**, and we’ll discuss the three most effective methods. The selection of the method typically depends on the availability of financial data and the specific context of the analysis. One of the traditional approaches is the formula-based method, but variations tailored for nuanced needs can lead to better results.

Using the EBITDA Formula

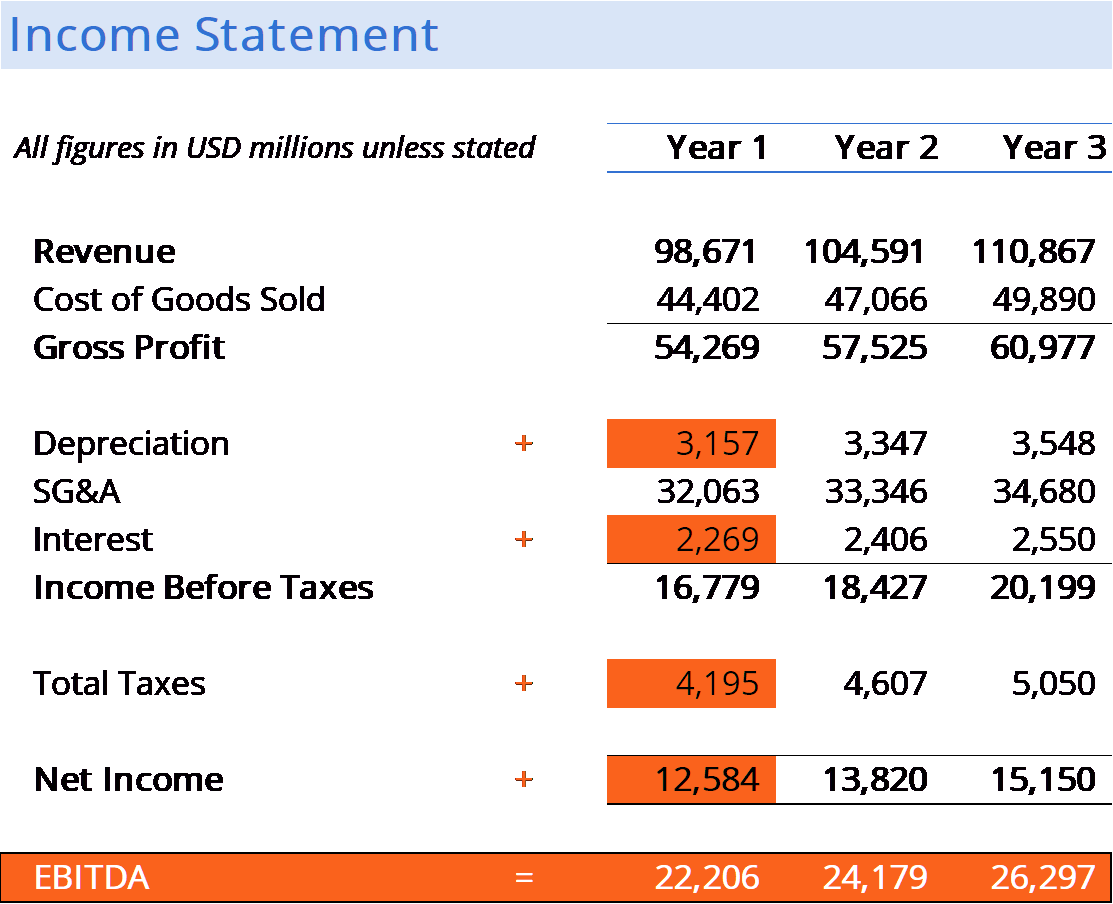

The **EBITDA formula** is straightforward. It typically begins with **net income**, to which we add back interest expenses, taxes, depreciation, and amortization. This can be summarized as follows:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Implementing this formula facilitates quick calculations for many companies, particularly when adjustments are minimal. For example, if a company has a net income of $200,000, with interest expenses of $20,000, taxes of $30,000, depreciation of $10,000, and amortization of $5,000, it can be calculated as:

EBITDA = $200,000 + $20,000 + $30,000 + $10,000 + $5,000 = $265,000

Calculating EBITDA Using Revenue and Expenses

Another method for **calculating EBITDA** involves using total revenue minus operating expenses (excluding interest, taxes, depreciation, and amortization). This enhances visibility into a company’s **operational performance** by focusing on revenues directly associated with business activities. The formula can be presented as:

EBITDA = Total Revenue - Operating Expenses (excluding interest, taxes, depreciation, amortization)

This method allows for a more intuitive understanding of how operational expenses directly affect profitability. This is particularly beneficial for those analyzing an **income statement** without extensive accounting training, as related financial complexities might be abstracted.

Understanding EBITDA Adjustments

While basic EBITDA calculations impart essential insights, companies often encounter unique financial scenarios necessitating **EBITDA adjustments**. These adjustments reflect non-recurring revenues or expenses, which may distort a company’s true profitability picture.

Examples of Common EBITDA Adjustments

Common adjustments may include management fees, one-time gains or losses, and significant litigation expenses. For instance, if a company incurs a one-off legal fee of $15,000 affecting its operational cost temporarily, it is imperative to adjust the EBITDA accordingly to reflect the more typical **operational efficiency**. This can be done as follows:

Adjusted EBITDA = EBITDA (Unadjusted) - Non-Recurring Costs

By making these adjustments, investors can achieve a more accurate assessment of a company’s long-term **financial performance**, enhancing the relevance of EBITDA as a metric for continuing operations.

EBITDA Margin Calculation

The **EBITDA margin** serves as another essential metric, calculated using the following formula:

EBITDA Margin = (EBITDA / Total Revenue) x 100

This percentage provides insights into the portion of revenue that converts directly to EBITDA, offering an advanced layer of **profitability analysis**. For example, if a company generates a revenue of $500,000 with an EBITDA of $200,000, the EBITDA margin would be:

EBITDA Margin = ($200,000 / $500,000) x 100 = 40%

This 40% figure signifies that 40% of its total revenue is retained as EBITDA and reflects operational soundness relative to total revenue generated, facilitating useful comparisons against industry benchmarks.

Best Practices for EBITDA Analysis

To fully appreciate the practical applications of EBITDA, employing best practices in **EBITDA analysis** can dramatically augment decision-making processes regarding investment and **business profitability** strategies.

Regular Monitoring of EBITDA Growth

Successful companies continuously track their **EBITDA growth** over time, facilitating effective **capital expenditures** decisions and strategic planning to enhance financial sustainability. By identifying growth trends, businesses can address performance-related issues proactively, emphasizing transparent insights for stakeholders focused on potential future earnings.

Frequent Comparisons Against Industry Standards

Using **industry standards** for EBITDA analyses is a smart strategy that can reveal how a company measures up against competitors. Factors like macroeconomic conditions, sector-specific challenges, and market trends play critical roles in EBITDA performance comparisons, giving investors and companies nuanced insight into operational strategies aligned with market demands.

Key Takeaways

- Understanding **how to calculate EBITDA** is crucial for evaluating a company’s fundamental **financial metrics**.

- Utilizing various methods allows for flexibility and accuracy in calculation based on available data.

- Regular adjustments are essential for capturing the true representation of a company’s profit metrics.

- Monitoring **EBITDA growth** and comparing results to **industry standards** helps in making informed strategic decisions.

- Finally, the emphasis on EBITDA margin strengthens evaluations of operational success relative to revenue.

FAQ

1. What is the full definition of EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric that provides a clearer picture of a company’s operational profitability by stripping out the effects of financing and accounting decisions.

2. How does EBITDA differ from net income?

While both reflect profitability, EBITDA focuses on operational efficiency, excluding interest, taxes, and non-cash items such as depreciation and amortization, making it a more relevant measure for comparing companies within the same industry.

3. Why are EBITDA adjustments necessary?

EBITDA adjustments are necessary to account for non-recurring items that could distort a company’s true earnings potential, thereby offering investors a more accurate depiction of ongoing financial health and operational performance.

4. How can I calculate the EBITDA margin?

The **EBITDA margin** can be calculated by dividing EBITDA by total revenue and multiplying by 100. This reveals what percentage of revenue is converted into EBITDA, providing insights into operational profitability.

5. What factors should I consider when analyzing EBITDA growth?

When analyzing EBITDA growth, consider factors like revenue trends, operational cost changes, market demand fluctuations, and overall economic conditions affecting the company’s performance.

6. Are there any limitations to using EBITDA?

Yes, EBITDA does not account for capital expenditures, changes in working capital, and does not include essential expenses like interest or taxes, which means relying solely on it may not give a complete financial picture.

7. How does EBITDA relate to financial ratios?

EBITDA is often used in various **financial ratios**, giving investors insights into valuation metrics such as EV/EBITDA (Enterprise Value to EBITDA), helping gauge market expectations and comparative worth within industries.

By applying these principles and methodologies, you can effectively leverage EBITDA in your financial analyses and investment considerations for 2025 and beyond.